Customer Lifetime Value (CLV) is one of the most important metrics for any company, whether they be in retail, eCommerce, SAAS or a business to business (B2B) market with repeat buyers. But how do you improve Customer Lifetime Value? And how, with the short cycle times of Agile Marketing, can you impact something whose effects are realized over the long time periods when Customer Lifetime Value plays out?

Customer Lifetime Value (CLV) is one of the most important metrics for any company, whether they be in retail, eCommerce, SAAS or a business to business (B2B) market with repeat buyers. But how do you improve Customer Lifetime Value? And how, with the short cycle times of Agile Marketing, can you impact something whose effects are realized over the long time periods when Customer Lifetime Value plays out?

What is Customer Lifetime Value?

The simplest way to define customer lifetime value is the value that you receive from that customer over some expected length of time, less the cost of serving and acquiring that customer. A simple formula might be

Average Revenue per Customer per month * Number of Months Customer Stays with You – Cost of Acquisition = Customer Lifetime Value

This formula might be a fine first approximation for a SAAS company with high gross margins, but there are several problems with it. If you’re not a software business, and you have significant Cost of Goods Sold, then you’re better off calculating contribution, rather than gross revenue. Just multiply revenue by gross margin to get contribution. Our new formula looks like this:

((Average Revenue per Customer per month * Gross Margin) * Number of Months Customer Stays with You) – Cost of Acquisition = Customer Lifetime Value

Of course not all companies have monthly recurring revenue. You may instead have customers who make initial purchases, and then may or may not make repeat purchases. In this case, your calculation is slightly different:

((Average Order Value * Gross Margin) * Repeat Purchase Rate) – Cost of Acquisition = Customer Lifetime Value

Segmenting Customers by Customer Lifetime Value

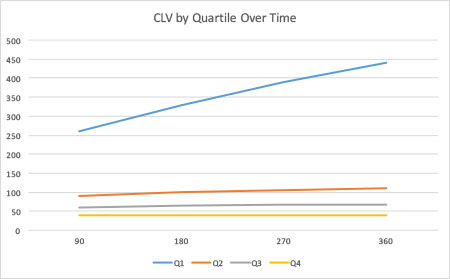

Once you have a calculation of Customer Lifetime Value by customer, you’ll want to segment those customers. Unless you discount too aggressively, you’ll often find that your most valuable customers in terms of customer lifetime value are also those customers who purchase the most from you early on. A graph of these customers might look something like this:

In other words, your top customers identify themselves early on by large purchases, and by repeat purchases. They often contribute disproportionately to the total.

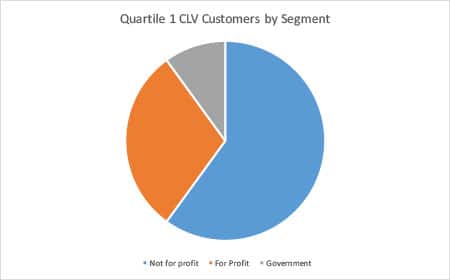

You may also want to segment your market by some market characteristic, and determine if different market segments contribute disproportionately to your customer lifetime value. For example, if you target the healthcare market, you might look at customers by their ownership structure (for profit vs not-for-profit vs government owned), or by their mission (teaching hospital versus general medical versus specialty) or by size (number of beds).

Agile Marketing and CLV

What does CLV have to do with Agile Marketing? I’m glad you asked. Simply put, segmenting your customers by CLV provides one of the most fruitful areas for experimentation and iteration, which are at the heart of Agile Marketing. Each Sprint. you should be asking “How can I improve the CLV of my top quartile of customers? How can I find more of them? What offers can I make that would appeal to them?”

In particular, if CLV is expressed in terms of gross margin, rather than in terms of revenue, iterations which increase CLV can contribute greatly to the bottom line of the business.

CLV also tells you how much you can spend to acquire a particular customer. For example, let’s say that you have a rule that you want to limit direct marketing expenditures to no more than 10% of expected CLV, but that’s not enough to compete for the ad words typically associated with some of the most valuable customers. By knowing the CLV of these valuable customers, and knowing their characteristics, you may be able to justify greater expenditure to acquire these particular customers.

You can also combine CLV analysis with share of wallet analysis. In other words, if you find customers who tends to produce high CLV, but you’re not getting much of their total business (you have low share of wallet), you may want to devise marketing programs which target those specific customers.

How many of you measure CLV today? Do you have plans to measure CLV? If you do measure it today, what trends are you seeing?

We measure customer lifetime value and find it a very difficult exercise. We tend to think others who measure it easily are either full of it or simpletons. Or maybe they have an easier exercise than we do.

If it were a question for a monthly subscription business of profit per month x average number of months, it would be easy. If we could segment by marketing channel or another customer aspect, we could then compare the segments. EZ peasy

Here’s the problem. Our customers often sign up, try it, then quit and take their money back within the two weeks trial. But this same customer might sign up months later and stick around for a long period of time.

Our core service is an online subscription educational service for kids. It turns out that the first sign up might have been just a trial for later.

Customers also quit after six months but come back six months later.

In both of these cases, they might come back through a marketing effort which means putting PPC ads in front of them. Do you assign the value of the second signup to the first case? Treat them separately?

Some customers add a child. Or remove a child. Others refer friends. Others refer lots of friends. It turns out that the arithmetic behind a meaningful calculation is tricky and involves lots of assumptions. Am I the only one with all these questions?

John,

You’re not alone. I’ve been reading Andrew Chen’s blog recently, and he’s also had a bunch of questions about calculating LTV in businesses that have very complex models. I have only two suggestions:

1) Can you implement a unique identifier and when you bring back a customer, for whatever reason, make sure that they have an incentive to self-identify as that previous customer, so that you can assign that unique identifier to them rather than generate a new one. Then you can run LTV calculations where there is essentially no difference between a customer that went away and came back versus the customer that simply didn’t purchase (but remained active) during that time period. Perhaps when they end their subscription, offer them “suspend” status, where they’re not paying subscription (or getting the service/product), but they can come back at any time. I’ve seen a couple of companies do that to me when I ended my subscription.

2) Can you simplify your math by having multiple models? For example, let’s say you have one model that looks at trials, and you’re focused on converting them to long-term paying customers. You might have a second model that looks at people who’ve gone past the trial phase, and look at their lifetime value. I don’t know enough about your business to say exactly how you do this, but sometimes making a simplifying assumption is good enough, when you think about what you want to accomplish.

Good luck

Jim